Table of Content

At 1st United Mortgage, we are still able to process some Streamlines without an appraisal, which is a tremendous benefit given the decline in home values across the country. Homeowners do pay closing costs on a VA Streamline, but these can be easily rolled into the overall loan amount, along with $6,000 in energy efficiency improvements. The VA home loan program offers two major refinance possibilities.

Any Veteran or service member, including members of the National Guard and Reserve forces, who experienced military sexual trauma is eligible to receive counseling. We offer grief and bereavement counseling if your service member died while serving on active duty. While these loans generally follow the same processing steps nationwide, the VA does set specific requirements for some areas.

Knoxville, TN specific requirements

Vet Centers are small, non-medical, counseling centers conveniently located in your community. They’re staffed by highly trained counselors and team members dedicated to seeing you through the challenges that come with managing life during and after the military. We provide private organizations and community agencies education on our Veteran community and military culture.

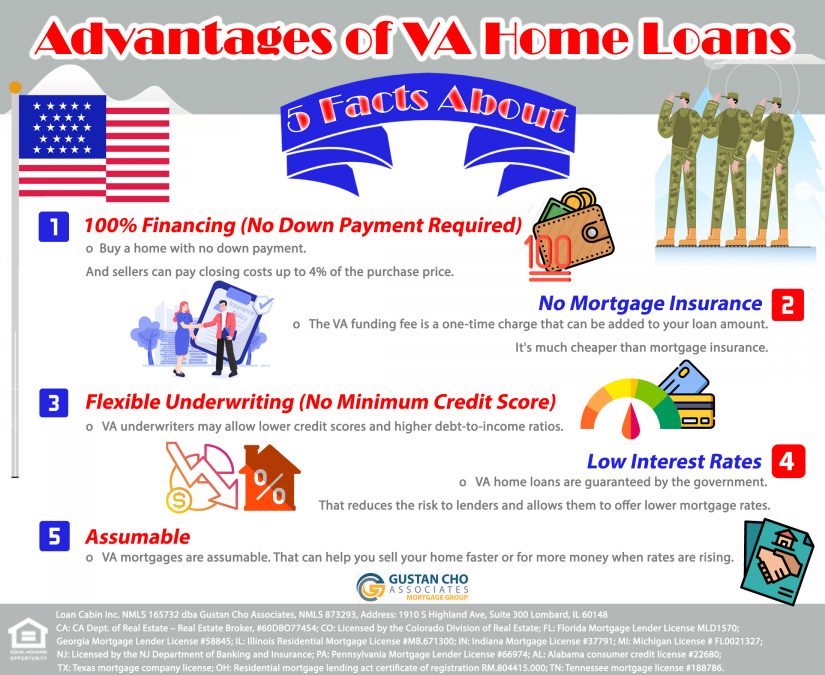

Once the requirements are met, veterans receive a financial guaranty from the VA. That guaranty gives lenders the confidence to issue no-down payment loans with great rates and terms. No down payment required Negotiable and competitive interest rate.

VA Home Loan Knoxville, IL

Interest Rate Reduction Refinance Loans is a program that helps current VA borrowers to refinance at lower interest rates with little to no out-of-pocket costs. IRRRL also means little paperwork, swifter processing times, and many times eliminates the need for an appraisal. In fact, this is often considered the most beneficial type of refinance option for veterans who currently have a VA loan. These loans are also available for any qualified veteran homeowner, whether they have a FHA, USDA or conventional loan. The VA Renovation Loan brings together some of the most innovative and attractive features of several popular mortgage programs.

Work with the highest rated and reviewed local Mortgage Broker in your area. If you take out a conventional loan and pay less than 20% down, you have to have private mortgage insurance on the loan, adding significant cost to the total price of the Knoxville home. But even if you finance the entire cost of the home, you do not need PMI with a VA loan, saving you a lot of money.

Get VA home loan benefits

He made himself available anytime…..even when he was on vacation! Overall we think Smart Mortgage is an excellent company willing to work with people with blemished credit and give them the opportunity to live their dream of home ownership. The below table looks at the average fees/closing costs and rates for VA 30 Year Fixed Rate mortgages originated by each lender at the Knoxville level. The situation is a bit different with Chapter 13 bankruptcy. You can still be paying on Chapter 13 bankruptcy and receive a Knoxville, IA VA loan—but you must have been making on-time payments for at least one year. Once again, a full explanation of the bankruptcy, a stable job, and the re-establishment of good credit will be required.

They're a great way to connect with people in your community. Vet Centers are community based to be more accessible in areas where you live. The kind of evidence you need to have to establish your eligibility depends on several factors. It shouldn’t be too difficult to get the required information and fill out the form. Knoxville is a city in, and the county seat of Knox County in the U.S. state of Tennessee.

If you're a female Veteran, ask for the Women Veterans Program Manager. My wife and I had the pleasure of being assigned to Ryan Sr. He was polite, patient, professional and most importantly prepared throughout whole process. Ryan crunched numbers with impressive accuracy, explained documents line by line when we had questions and let us know what to expect so there wouldn’t be any surprises. Ryan is very knowledgeable and had no problem answering questions and sharing very important details which made us feel good about picking Smart Mortgage.

This means that you can get a better home for the same monthly payment than you would have been able to without the Knoxville VA loan program. To start, lenders set their rates based on what’s happening in the bond market. This is why interest rates change constantly, even multiple times per day. Because of this movement with interest rates, it’s important to talk with your loan officer about when to lock in yours. As with other lending products, military members with excellent credit can secure better interest rates and loan terms than those with less sterling credit.

Together, we build referral networks to expand support for Veterans, service members, and their families. We offer individual and group counseling for those who have experienced military sexual trauma. We currently have both male and female counselors that can help.

We report statistics on every mortgage lender that we can collect data on-- not just those who pay for inclusion. We source our data from authoritative sources, and ensure to the best of our abilities that it is accurate. The top Knoxville VA lender as defined by loan originations is QUICKEN LOANS, LLC, with 357 VA loans originated. Their average total fees are $5,441, which is $750 lower than the next largest lender, Mortgage Research Center, LLC. These refinances can be used for homes that are the principal residence of the owner and the VA will guarantee loans up to 100% of the value of the home.

No comments:

Post a Comment