Table of Content

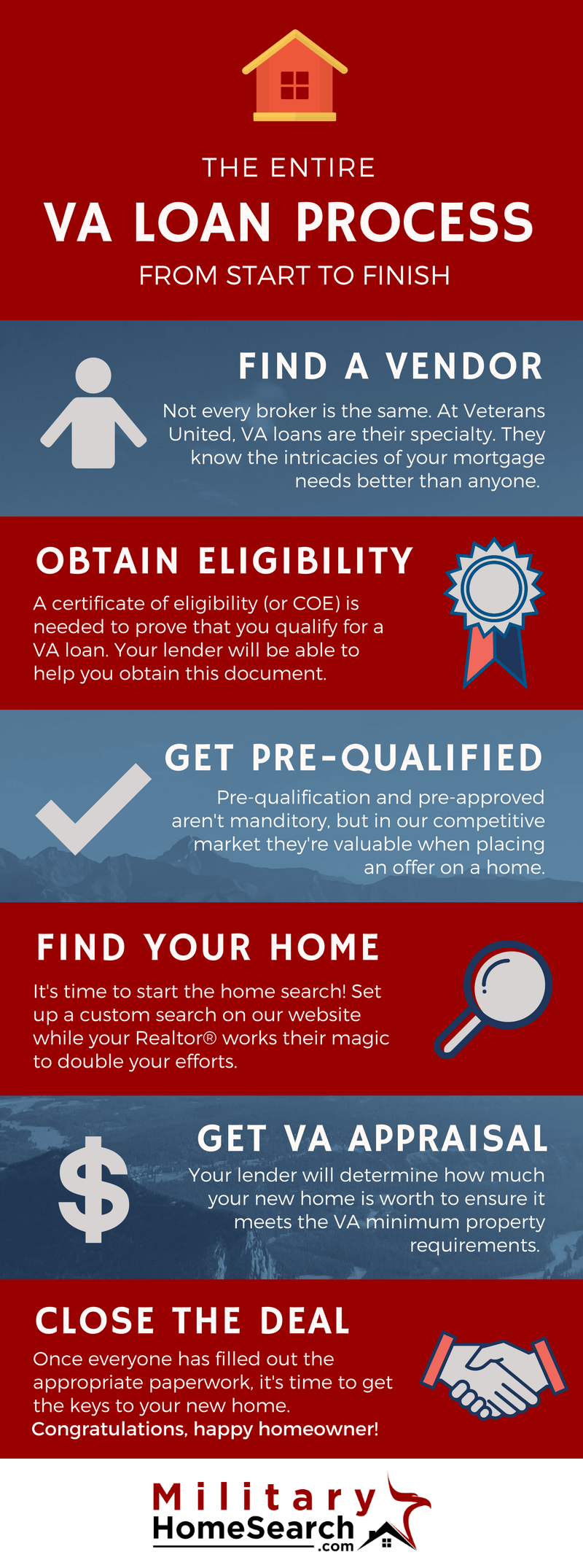

Before approving a VA mortgage, the Department of Veterans Affairs will usually need to ensure that risk is minimized. While it might not be required in every state, termite and pest inspections are a vital part of the VA home loan process. Requirements for VA mortgages are generally set along the same lines as conventional home loans. In addition to functioning electrical and plumbing systems, your target property will need to have a safe source of water. Borrowers will still need to be approved by a qualified lender under VA loan conditions in order to secure this type of mortgage.

This benefit opens the doors of homeownership to those who might otherwise struggle with financing. For eligible veterans and active duty military personnel a Knoxville VA mortgage loan can be a wonderful benefit to take advantage of. One of the key factors in securing a good deal on a home purchase is having a high credit score. In fact, you often need a good credit score to get a mortgage at all. But it’s different with VA loans in Knoxville, IA—you can usually get a good loan even with a low credit score and a short credit history.

Other VA benefits and services

VA loans offer affordable homebuying options for active service members, military veterans and their families. Provided by the United States Department of Veterans Affairs, these mortgages offer advantages that ease the financial burden on prospective homebuyers. Veterans and active duty homeowners who qualify can refinance into a VA loan using the program’s cash-out refinance program. Qualified homeowners with conventional or FHA mortgages do not have to take out cash when they refinance into a VA loan. But they are ineligible for the simpler VA Streamline program.

Veterans Administration loans were created to help veterans finance the purchase of their new homes, or the refinance of their current home. They are offered to Active Military personnel and those that have served in the past. They offer 100% financing with NO down Payment on most loan products and do not require mortgage insurance. The loans are fixed rate for the life of the loan and do not have a pre-pay penalty.

HomeRate Mortgage $1000 Guarantee!!!!

This is a must if you wish to find the best mortgage loan with the appropriate features and lowest interest rates. The first thing that you should do is to compare house loans by asking for a loan estimate from the lenders. Basically, you will have to ask for a loan estimate from many lenders since this will provide you the information that you need to understand about their features and fees.

This means that you can get a better home for the same monthly payment than you would have been able to without the Knoxville VA loan program. To start, lenders set their rates based on what’s happening in the bond market. This is why interest rates change constantly, even multiple times per day. Because of this movement with interest rates, it’s important to talk with your loan officer about when to lock in yours. As with other lending products, military members with excellent credit can secure better interest rates and loan terms than those with less sterling credit.

VA Loan Basics

The process for obtaining a Cash-Out Refinance is similar to the process borrowers go through for a VA purchase loan. Veterans with a conventional or FHA mortgage can refinance into a VA loan using the Cash-Out program. A VA entitlement isn’t a one-time benefit and qualified borrowers can use it multiple times. Granted, most veterans will only have a single VA-backed mortgage at any given time. There are unique situations where veterans would have more than one VA loan due to relocation needs, such as deployments and/or employment.

We offer assessment and support through private counseling and group therapy. We can also refer you to VA or community counseling for treatment and therapy resources. If you’re struggling with issues like PTSD, depression, grief, anger, or trauma, we offer counseling and other support. We’ll work with you to help you achieve your personal goals. We participate in a variety of community and educational events. Many events are free for Veterans, service members, and their families to attend.

We also offer many other loan options for those not eligible for a VA loan, including FHA & other conventional loan options. Reduced funding fee on new VA loan, No appraisal required, lower VA interest rate. Our services are also available to family members when their participation would support the growth and goals of the Veteran or active-duty service member. We offer confidential help for Veterans, service members, and their families at no cost in a non-medical setting. Our services include counseling for needs such as depression, posttraumatic stress disorder , and the psychological effects of military sexual trauma .

Without paperwork, the loan process won’t necessarily derail, but it’s always best to take care of document needs quickly by wokring with a lender. VA borrowers can add up to $6,000 to their loan earmarked for energy efficiency improvements, known as an energy efficiency mortgage, or EEM. With an EEM, homeowners can make select upgrades and repairs to the property for maximum energy efficiency. Since VA lenders ultimately issue the loans, they have their own unique requirements, especially regarding credit scores. Prospective borrowers must satisfy both guidelines – those set by the VA and the ones set by agency approved lenders.

We can connect you with educational and career counseling, mental health services, and other programs and benefits that will support your transition. No, since VA loans are backed and guaranteed by the US government, private mortgage insurance is not required. This, in addition to zero down payments and lower interest, Could save VA loan borrowers throughout the mortgage's term. If you’re looking for a personal mortgage experience you’ve come to the right place.

With many traditional construction to permanent loans, the buyers will have to re-qualify at the end of the construction phase. Now the buyers can enjoy preparing for life in the new home without concern that purchasing new furniture or other items could impact their loan approval. Once this form is completed, a local VA mortgage consultant will be reaching out to you. You will receive an instant email with the credentials of your VA consultant with contact information and a photo. We look forward to assisting you with your home buying or refinancing needs. You can usually get a good loan even with a low credit score and a short credit history.

The property cannot be a working farm or an income-producing property. To make energy-efficiency improvements in conjunction with a VA purchase or refinance loan. Yes, veterans and service members may have a co-borrower, but there are certain restrictions. For a VA loan, that co-signor must be either a spouse or another veteran. That means parents, friends and significant others who don’t fall under one of those two headings cannot be a co-borrower on a VA loan.

No comments:

Post a Comment